COMPLIANCE & RISK MANAGEMENT

Defend your business.

Simplify compliance.

Compliance and risk management are non-negotiable—but they don’t have to be a headache. Amplify Defender streamlines the tedious work of monitoring risk and meeting regulatory requirements, saving advisors and compliance teams countless hours. With built-in, integrated tools to record suitability, monitor client portfolios, track employee personal transactions, and simplify ADV filings, Defender keeps you covered without slowing you down.

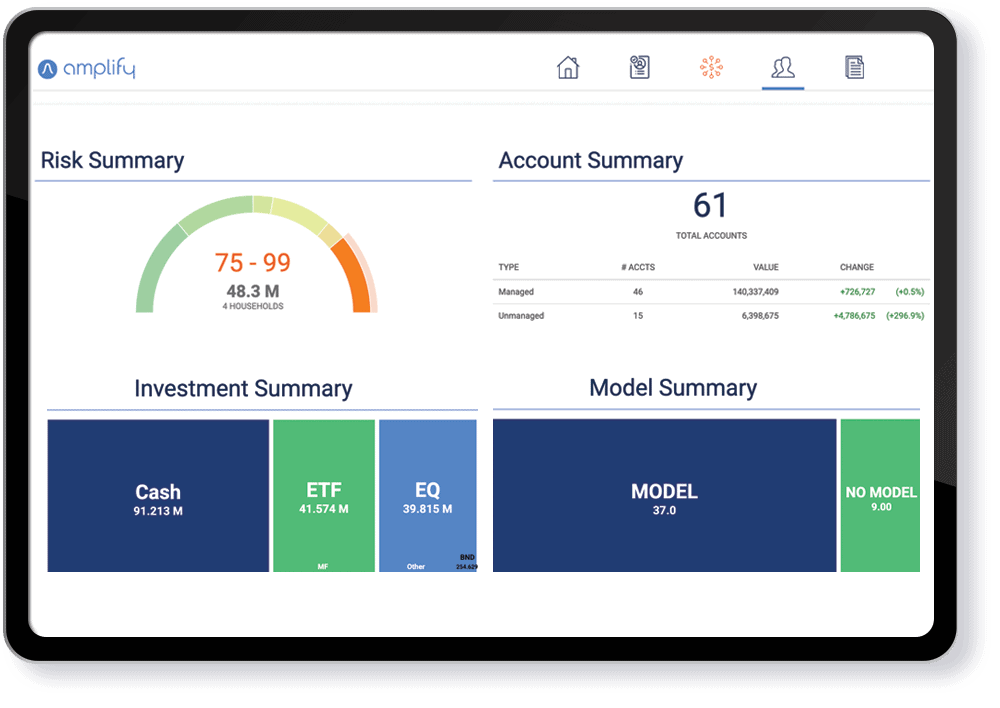

Monitor risk tolerance across all clients in real-time

- Automatically monitor all client portfolios to ensure they stay within their risk tolerance.

- Receive real-time alerts for any drift, so nothing slips through the cracks.

- Automate portfolio oversight for every client, saving hours of manual work for compliance teams.

- Built directly into Amplify, eliminating the need for external tools or extra processes.

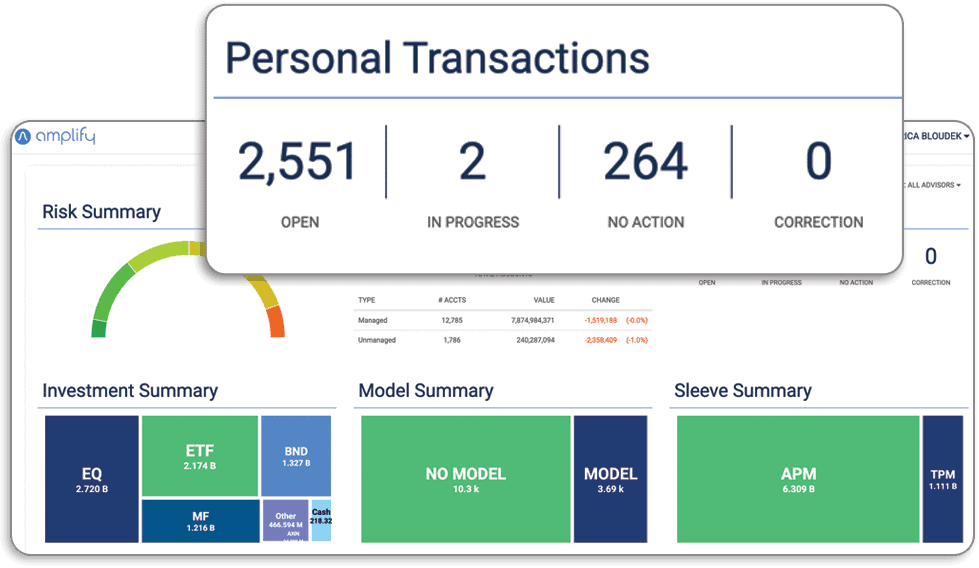

Track employee transactions

- Monitor advisors’ personal trades to ensure they don’t receive preferential execution over clients.

- Strengthen firm integrity with automated checks that reduce manual oversight.

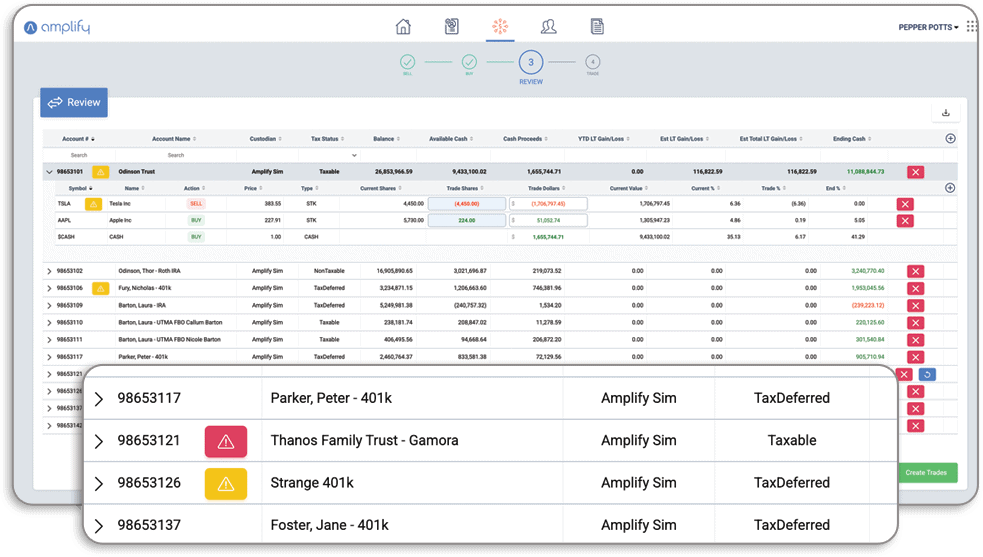

Simplify ADV filings across custodians

- Manage annual ADV filings with an intuitive dashboard designed for firms of any size.

- Streamline reporting across multiple custodians, removing the complexity of fragmented data.

- Save time for compliance teams while ensuring thorough, timely, and accurate filings.

Simplify and speed up your compliance

Stay ahead of risk and regulation with Amplify Defender—a smarter way to protect your reputation and your business.