QUANTUMRISK™

A Smarter Way to Assess Risk

RIA Risk Assessment Tools Take a Quantum Leap

The Fatal Flaw.

Wall Street’s most brilliant financial analysts have known for decades–and RIAs should have realized–that since 2008, standard deviation is a crude cartoon of risk. It assumes returns behave like a normalized bell curve, even when the market clearly doesn’t. Yet every mainstream risk tool still sells based on that single, static number.

Don’t you think it’s time risk assessment caught up with reality?

The Quantum Leap.

Amplify QuantumRisk™ replaces the obsolete snapshot of standard deviation with present-day risk exposure and its historical context. It directly recreates the theoretical returns of the client’s portfolio using today’s weights.

- High-performance computing engine simulates millions of fat-tail outcomes in less than a second, with no correlation matrix.

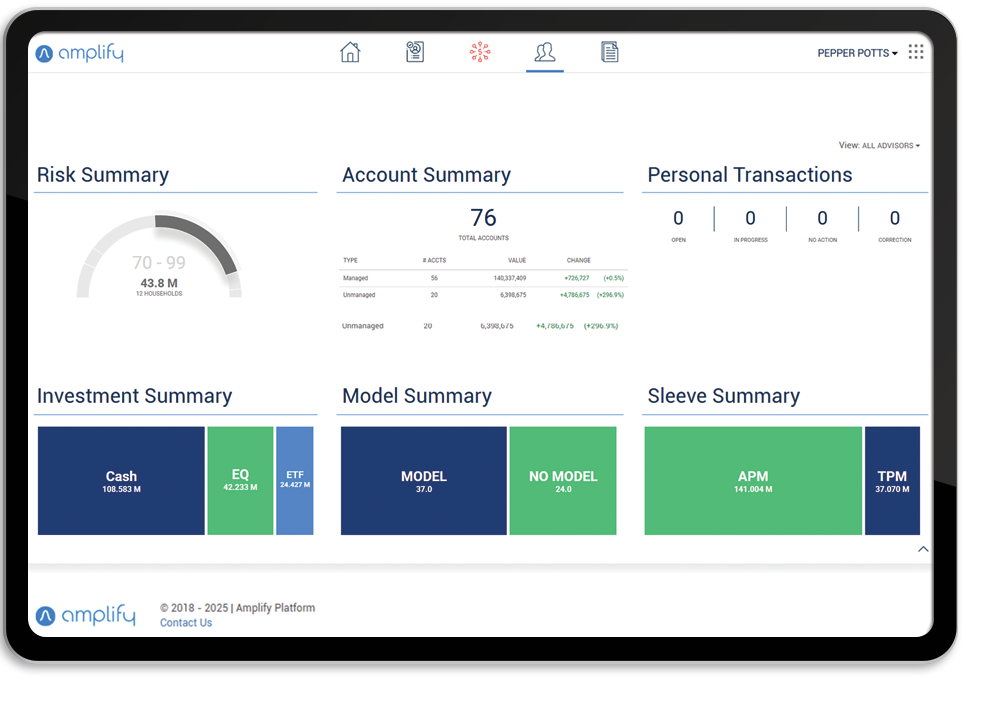

- Translates complexity into a single, intuitive risk view where investors can instantly grasp portfolio composition, trading style, and volatility in a single widget.

- QuantumRisk™ is Amplify’s proprietary risk assessment engine fueled by Dr. Ron Piccinini’s groundbreaking research on Fat Tail Risk.

What is the QuantumRisk™ Score?

- The QuantumRisk™ Score is a data-driven framework that evaluates investment risk by comparing it to the risk of the S&P 500. With a standardized scale from 0 to 1,000, it provides a consistent way to understand and compare the risk of different securities and portfolios.

- What sets QuantumRisk™ apart is its focus on tail risk, meaning the potential for significant losses in extreme market conditions. Rather than compressing risk into a narrow range, as many traditional models do, the QuantumRisk™ Score maintains clarity across the entire risk spectrum, which is especially helpful when evaluating portfolios, individual securities, or leveraged products.

Disclosure: The QuantumRisk™ Score is a proprietary metric and should not be interpreted as a guarantee of future performance or risk outcomes. It is one of many tools that can support risk evaluation and should be used in conjunction with other due diligence measures. This information is intended for financial professionals and other qualified experts. It is not intended to be relied upon by retail investors as the sole basis for making investment decisions.